The BIGGEST GROWTH OPPORTUNITY In The HISTORY Of Capitalism

-McKinsey & Co.

Investing in Emerging Market Technology Companies

Understanding EMQQ

The Emerging Markets Internet & Ecommerce ETF (NYSE: EMQQ) seeks to offer investors exposure to the growth in Internet and Ecommerce activities in the developing world as middle classes expand and affordable smartphones provide unprecedentedly large swaths of the population with access to the Internet for the first time.

EMQQ ETF tracks an index of leading Internet and Ecommerce companies that includes online retail, search engines, social networking, online video, e-payments, online gaming and online travel.

Top 10 Holdings

As of 04/24/24

RELIANCE INDUSTRIES LTD ORD

— 9.80%

TENCENT HOLDINGS LTD

— 7.69%

ALIBABA GROUP HOLDING LTD

— 7.48%

MEITUAN

— 7.24%

PINDUODUO INC

— 6.62%

MERCADOLIBRE ORD

— 6.61%

NETEASE INC

— 3.59%

NASPERS LTD-N SHS

— 3.52%

JD.COM INC - CL A

— 3.36%

SEA LTD

— 3.27%

Holdings are subject to change

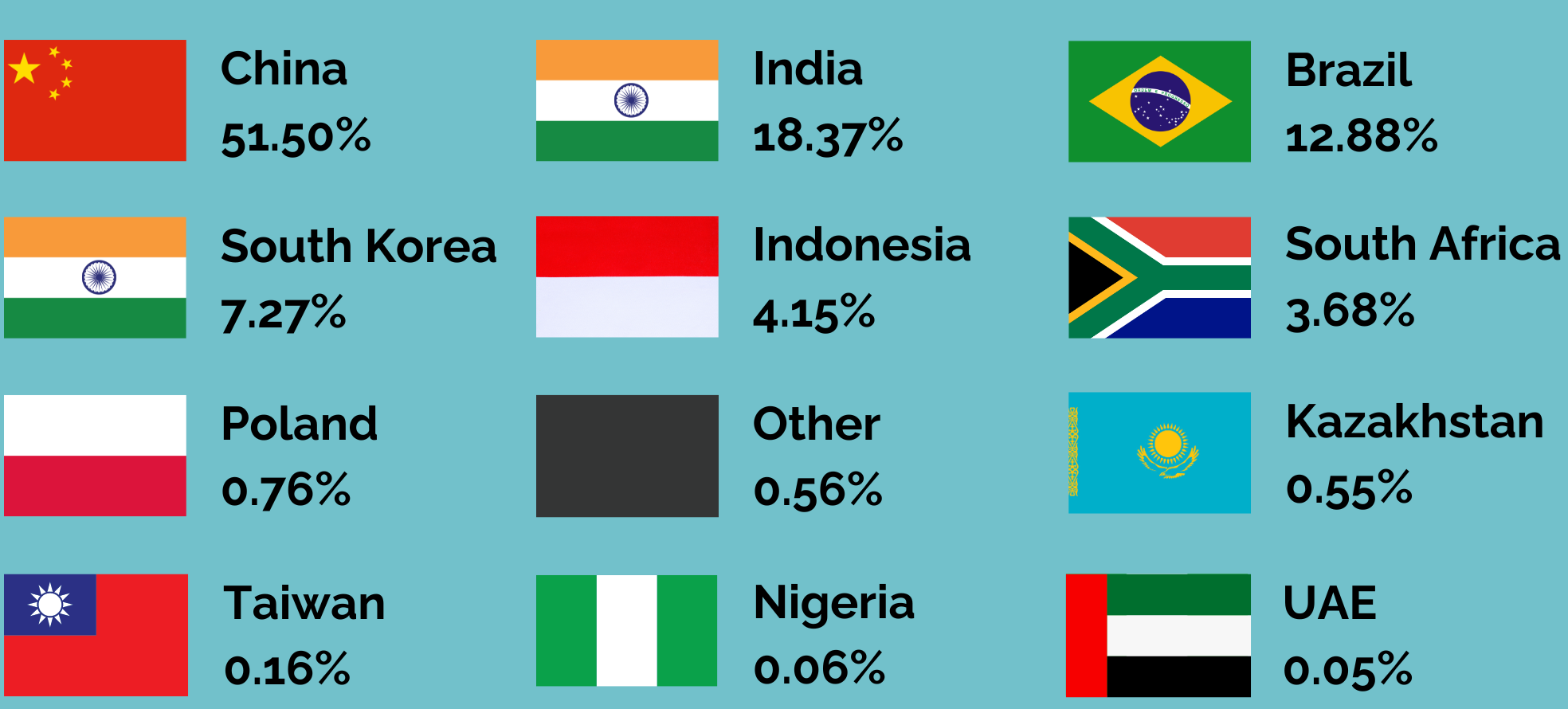

Country Weightings

3/31/24

EMQQ IS

THE #1

EMERGING

MARKETS

ETF

Only 45% of People in Emerging Economies Own Smartphones

Growing Rapidly, Infrastructure

Developing Around Internet Technology

Compared to 77%

in Advanced Economies

Slowly Increasing, Technology

Developing To Work With Existing Infrastructure

Recent News

EMQQ Investment Strategy

EMQQ is designed to provide investors with exposure to the internet and ecommerce sectors of the developing world Many investors believe that the growth of consumption in emerging markets represents a significant growth opportunity as more than one billion people are expected to enter the consumer class in the coming decades. Increasingly, these consumers are using smartphones and broadband mobile connections to access the internet, EMQQ holds companies operating in Emerging and Frontier Markets including China, India, Brazil, South Korea, Taiwan, South Africa, Mexico, Argentina, Malaysia, Thailand, Indonesia, Vietnam, Philippines, Turkey, Czech Republic, Poland and Colombia, Singapore, Netherlands, Germany, Cyprus, Japan, Kazakstan, United Arab Emirates and others.